2. The Link to Business Results

The Link to Business Results

Business results matter. And these results can be improved by engaging more women.

The evidence is compelling and mounting – from the mining sector and across other industries. Our Action Plan is founded on the knowledge that inclusion of women in leadership, technical and trades positions can translate to significant improvements in important business results1.

Attracting and Retaining Valuable Talent

An industry, or a company, characterized by gender diversity and an inclusive culture has the features that make it a magnet for talent.

Attracting talent is a critical business issue. Ernst and Young has consistently ranked skills shortage among the top risks to the global mining industry. In 2011, prior to the downturn, skills shortages were seen to be the second-greatest risk. Their most recent analyses have lowered the risk, but highlight that the problem has become more complex than a narrow focus on shortages. They identify diversity and having the right mix of skills as key to culture change for productivity improvement, innovation, and switching to a preparation for growth (Ernst & Young, 2016).

Failing to attract the most talented employees has a domino effect on business results. When employers are forced to hire from a dwindling pool, the quality of their hires can drop, starting a downward spiral of lower productivity and higher costs2. Mine managers will generally agree that having the best-qualified hires compared to settling for the same number of mediocre hires translates into a significant difference in productivity. Yet women are still underrepresented in the mining workforce, even compared to other predominantly male sectors. In 2015, 19% of the labour force in mining, quarrying, and oil and gas extraction were women compared to 23% in utilities and 28% in manufacturing (Statistics Canada, 2016).

The Mining Industry Human Resources Council (MiHR) has analyzed labour market statistics that reveal how Canada’s mining industry, in particular, is missing out on available talent. The gap is widespread. MiHR has demonstrated that the gap cannot be explained by our industry having more occupations that are traditionally associated with a greater percentage of men. In fact, even within a given occupation, MiHR’s analysis of seventy occupations shows that mining has a lower representation of women compared to the very same occupation in other industries. Importantly, this holds true whether the occupation is traditionally associated with a higher representation of women (e.g., human resources) or a lower representation of women (physical sciences or trades and production). For example in STEM3-related fields, 19% of Canada’s professional and physical science occupations are held by women; in the mining industry, women represent only 16% (MiHR, 2016b).

Changing these numbers requires outwardfocused action to fill the talent pipeline – to encourage more women to enter mining-related training programs and occupations. However, a recent PWC analysis (Women in Mining UK, 2015) of the top 500 listed mining companies (globally) confirmed our industry has a “leaky pipeline” – we have higher percentages of women at entry levels and consistently lower levels at more senior executive positions. The PwC forward projection even suggests that the supply of female talent within the industry might actually be falling.

To keep women in the industry, we also need inward-focused action that changes workplace cultures. There are important benefits to those changes. In 2012, turnover was costing the Australian mining industry AU$140M annually (Kinetic Group, 2012). Workplace cultures that encourage greater participation by women share many of the same characteristics as those that maximize employee satisfaction and engagement, and reduce costs related to illness, injury and turnover.

As leaders, women are seen to frequently demonstrate three of the four behaviours that are most effective in addressing the global challenges of the future – intellectual stimulation, inspiration, participative decision-making, and clear expectations and rewards (McKinsey & Company Inc., 2008). Productivity and innovation in our industry can be enhanced by increasing the numbers of women and creating the work environments that will keep them and leverage their contributions.

Overall, the need for skills at all levels of our industry is a longterm structural challenge in the labour market – it will outlast the current downturn. The mining industry has to position itself to attract its fair share of the talent pool – including women.

1 Watch www.mihr.ca for an e-learning module on documenting the business case for gender equity at your work site or company; it is expected to be available in 2017.

2 For example, even conservative estimates can demonstrate that for a mine site hiring 30 new electricians, for example, the difference in productivity will exceed $350,000 over three years (McLean, 2003). This occurs because better hires are more productive – and an ‘employer of choice’ attracts more applicants, can be more selective in making its offers, and has more of their employment offers accepted by qualified candidates.

3 STEM refers to Scientific, Technical, Engineering and Mathematical fields.

Supporting Safety

Gender-inclusive workplaces have a culture that is more congruent with a safety mindset.

The link between gender inclusion and a safety orientation has been documented through some insightful case studies and applied research in dangerous, male-dominated work settings – offshore oil drilling platforms, coal mining and others (Ely & Meyerson, JulyAugust 2008; Ely & Meyerson, 2010; and Laplonge & Albury, 2013). The researchers have found that in these environments, workers (who are most often men) try to appear infallible to impress coworkers and bosses. Those efforts to appear invulnerable block the kinds of behaviours and discussions that encourage safety and productivity. A better gender balance reduces these tendencies.

Dr. Catherine Mavriplis, holder of a NSERC Chair for Women in Science and Engineering, emphasizes women’s contribution to health and safety: “Women [notice] situations that look dangerous, and their first reaction may be ‘Let’s stand back for a minute and look at this’ – such intuition is an asset.”

Women Building Futures is an Edmonton-based organization that trains and readies women for successful trades and labour careers in construction. The feedback they get from employers is that their women graduates treat equipment well – and are open to being coached. Fewer incidents, fewer injuries, and fewer repair costs – these are all important benefits to cost-conscious employers.

The global mining industry has several examples of the benefits of a workplace that is inclusive for women. For example, Australian women haul truck drivers are now in high demand because of the evidence that a gender-inclusive workplace produces a more balanced group dynamic as well as less wear and tear on the equipment (Bhandari, 2010; Bhandari, 2014; Koch & Walker, 2010; Skinner, 2010; and Stephenson, 2008). In Canada, Cameco Corporation has noticed evidence of a difference in approach between men and women on maintenance crews and in technical roles. Differences in how they used equipment and camp property translated directly to a positive cost-benefit for repair and replacement costs (Cameco representative, personal communication, September 2015).

Gender-inclusive workplaces also generate less “wear and tear” on the people who work in them. For example, finding safer and ergonomically better ways to move heavy items makes the work more accessible to a wider range of people (women and men) and also reduces back strain for everyone. Beyond the physical

aspects, the culture in gender-inclusive workplaces has characteristics that are linked to lower absenteeism, less health-damaging stress, teamwork and “looking out for each other” and lower turnover (and therefore fewer inexperienced at-risk workers).

Better Decision Making and Better Performance

New research from The Peterson Institute for International Economics shows that having more women leaders in business can signficantly increase profitability. Their study of almost 22,000 firms across the globe has shown that a company with 30% women leaders can add up to 6 percentage points to its net margin, compared to other companies in the same industry (Noland, Moran, & Kotschwar, 2016).

Starting at the Board level, many other studies of corporate results across industries show that companies with mixed gender boards financially outperform those with all-male boards. This is because the board members work together differently, in ways that reflect the best governance practices. For example, boards with both women and men tend to be more active in overseeing the strategic direction of the company, in reinforcing accountability through audits and risk management and in making decisions more objectively. They are more likely to use recognized best practices such as:

- Identifying clear criteria for measuring corporate strategy.

- Monitoring implementation of corporate strategy.

- Using outside search firms to source new board members.

- Providing board orientation programs for new directors.

- Conducting formal board director performance evaluations.

- Making fewer risky acquisitions.

- Adopting written policies to limit the authority of board directors.

(See for example Adams & Ferreira, 2009; Bart & McQueen, 2013; Brown, Brown, & Anastasopoulos, 2002; Levi, Li, & Zhang, 2014; Nielsen & Huse, 2010; and Schwartz-Ziv, 2013.)

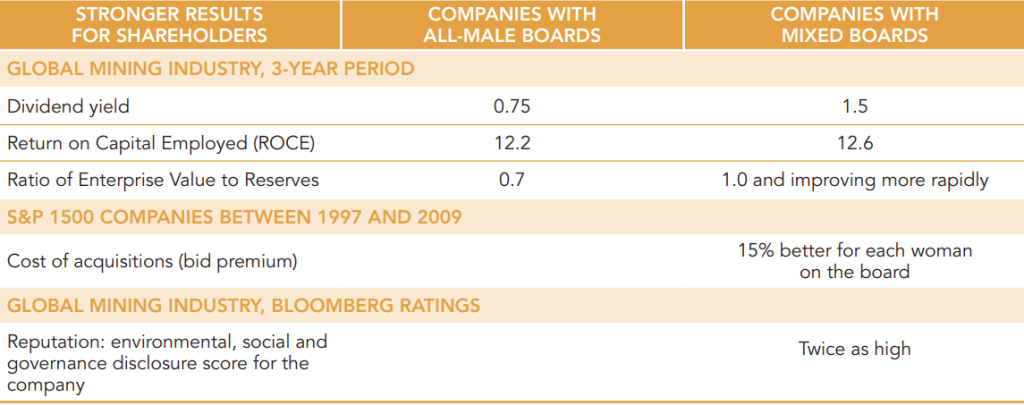

With these better practices, greater numbers of women on a board are linked to significantly stronger financial results for their companies’ shareholders.

(Note: For these and other results see Women in Mining UK, 2015)

The bottom line

A 30% critical mass of women directors on boards has been found to have the most positive impact on company performance. At the current rate of change it will take until 2039 for the top 100 listed mining companies (globally) to reach this 30% threshold and until 2045 for the top 500 to do the same (Women in Mining UK, 2015).

At levels below the Board, this same finding applies – companies with higher percentages of women decision makers financially outperform their industry peers. Across the economy, the percentage of women corporate officers is positively linked to better financial performance (Catalyst, 2008; Catalyst, 2011).

Worried about downturns? The evidence, and corporate governance and economic theories4, show that the enhanced performance makes an even greater difference through an economic downturn and early stages of a recovery. A 2012 study by Credit Suisse found that the financial benefits linked to having women on boards were more pronounced in the post-2008 period than in the three years leading up to the stock market crash. The researchers concluded that gender balance on the board brings greater stability throughout the market cycle (Credit Suisse Research Institute, 2012).

The evidence is mounting – companies that are more inclusive of women and men have better results

4 See for example the description of Adam Smith’s views of ‘agency costs’ during and after an economic downturn, in a report by The Conference Board of Canada on the business case and governance benefits of greater proportions of women on boards of directors (Brown, Brown, & Anastasopoulos, 2002).